Checkbook, Equities and Participant Loan

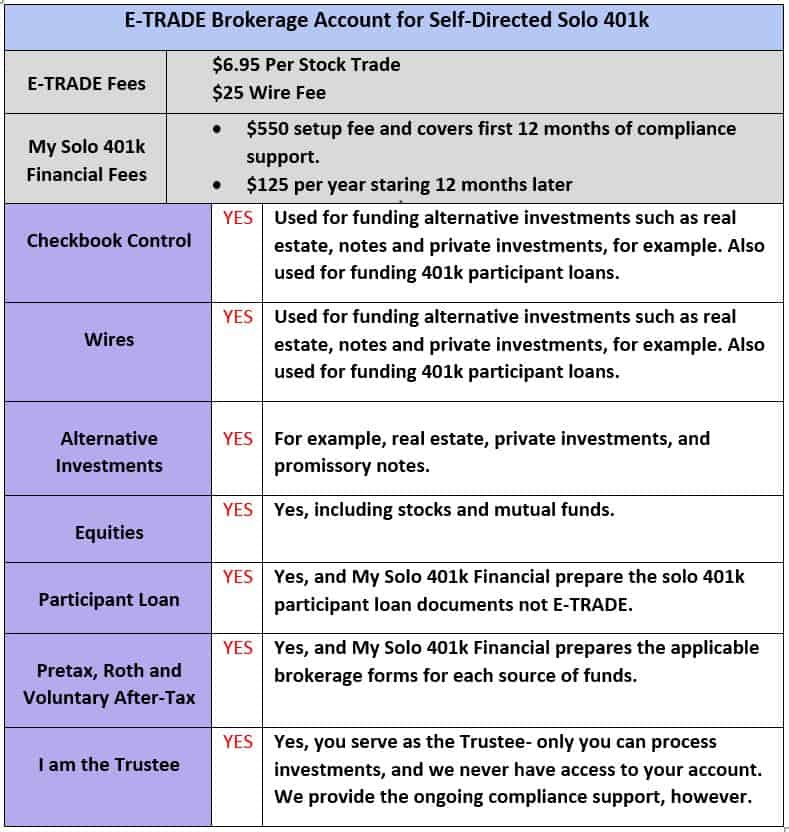

An E-Trade Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, promissory notes, tax liens, private shares as well as process a solo 401k participant loan.

A Brokerage Account at E-Trade for a Solo 401k with Checkbook Control Allows for the Following

Checkbook

Fund Solo 401k alternative investments, e.g., real estate, precious metals, tax liens, promissory notes, private placements, etc. by writing checks from the Solo 401k E Trade brokerage account.

Solo 401k Participant Loan

After we prepare Solo 401k loan documents, process the solo 401k participant loan directly from the solo 401k plan E-Trade brokerage account. All loan payments will also flow directly to the Solo 401k E-Trade brokerage account.

Brokerage Account

Continue to trade equities and grow your retirement funds tax-deferred, deposit investment gains from your solo 401k’s alternative investment holdings (e.g., rent check proceeds from real estate) directly into your solo 401k E-Trade brokerage account, and make your annual solo 401k contributions directly into the brokerage account.

How it works

E-Trade is simply providing a brokerage account for your Solo 401k, and My Solo 401k Financial is your Solo 401k plan provider and compliance support provider. In other words, even though E Trade also offers a solo 401k, their Solo 401k plan document restrict you to only investing in stocks and mutual funds; however, by using our solo 401k provider plan document and support services, which allows you to serve as trustee of the Solo 401k and invest in alternative investments such as real estate, precious metals, tax liens, promissory notes, private stock, etc., as well as process Solo 401k Loan, E Trade is not involved in the administration of the Solo 401k.

Documents for Opening ETRADE Solo 401k Brokerage Account

To open the E-Trade brokerage account for the solo 401k with checkbook control, you will need to submit the solo 401k plan documents that My Solo 401k Financial will prepare in 24 hours along with E-Trade’s special brokerage account forms and checkbook paperwork which we will also prepare.

Converting Existing E-Trade Solo 401k to your Solo 401k QUESTION:

I’m considering opening a Solo 401k with you. As is, I have an ETrade solo 401k but my situation is becoming more administratively complex and I’d like to begin taking advantage of the mega roth. It’s nice to not have administrative fees but it would also be nice to have professional support.

ANSWER:

The existing E-Trade Solo 401k can be restated to a self-directed solo 401k with our company which allows for voluntary after-tax contributions and those funds can then be converted to a Roth IRA or to the Roth solo 401k designated account. Our self-directed solo 401k plan also allows for Roth, pretax and voluntary after-tax contributions. We would handle the conversion documentation including issuing the Form 1099-R to document the conversion with the IRS. Our services also include preparation of Form 5500-EZ upon your request once the total value of the solo 401k plan exceeds $250,000, with the form due to the IRS by July 31 each year.

Use E-TRADE for Mega Backdoor Roth Solo 401k QUESTION:

I would like to open my solo 401k for me and my wife under our SCORP. I already have an e-trade 401k but they no longer allow for the backdoor roth solo 401k.

ASNWER:

I understand that you already have the solo 401(k) at E*TRADE. In this case, the process would be to restate the existing solo 401(k) at E*TRADE under our solo 401(k) plan. This would entail using our solo 401(k) plan document to draft a restated plan. As part of this process, we can simply list your S corporation. Please see more here: https://www.mysolo401k.net/etrade-solo-401k-restatement-review-how-to-change-to-a-self-directed-solo-401k/

As part of this process, new accounts will need to be set up and those new accounts can also be at E*TRADE. As part of our onboarding process, we will prepare the paperwork to open new accounts as well as the paperwork to transfer the cash and assets from the existing accounts to the new accounts.

Mega Back Door Roth E-Trade QUESTIONS:

Would I open the eTrade brokerage through you? Can the after tax contributions also be immediately rolled into a ROTH IRA? Would I open the ROTH IRAs at eTrade through you as well?

ANSWERS:

Thank you for your inquiry. Click HERE to Get Started.

If you are self-employed with no full-time W-2 employees working for you (other than you and your spouse), you can set up a solo 401(k) plan. It would be just one plan but multiple sub-accounts.

Our plan certainly allows for all of the features that you are looking for and described below. Moreover, we will handle all the related compliance matters such as 1099-R reporting to report the conversions and transfers.

Once you change your entity type from a sole proprietorship to an LLC taxed as an S corporation, you will simply need to let us know so that we can update the plan documents.

If you wish to have the accounts at E*TRADE we will prepare all the paperwork needed to open up brokerage accounts for you and your spouse. Of course, we will not be on the paperwork or the account but we do prepare all the documents to make it easy.

After-tax contributions can be immediately rolled over to a Roth IRA. Even though this is a nontaxable transfer provided there are no gains on the voluntary after-tax funds at time of the conversion it would still be a reportable event and we would handle the required 1099-R reporting as part of our services for no additional charge. It is not necessary for the Roth IRA to be at E*TRADE.

ELIGIBILITY: In order to set up a solo 401(k), you must be self-employed (or pursuing self-employment) with no full-time W-2 employees working for you. Ultimately, it is going to come down to how you are compensated & report your income on your

Use My Existing E-Trade Brokerage Accounts QUESTION:

ANSWER:

E-TRADE won’t allow you to use the existing brokerage account since you are moving away from their solo 401k to a solo 401k plan offered by our firm. New accounts will need to be opened (whether at E-Trade or at another institution) and the cash/investments transferred from the existing accounts. You would complete the next steps questionnaire to direct us to prepare the paperwork to open the applicable accounts as well as to guide you through the transfer process.

Use Pretax Brokerage Account to Hold Voluntary After-Tax Funds QUESTION

Does your process require that new separate brokerage accounts be set up for the voluntary after-tax employee contributions, or do I continue to make those contributions to the pre-tax accounts but track them separately for when I do a mega-backdoor and transfer the funds to the Roths?

ANSWER:

No – new voluntary after-tax accounts need to be opened to comply with the Mega Backdoor Roth Solo 401k rules.

EIN for Solo 401k QUESTION

Your next steps login process asked for state & county info so that an EIN could be obtained for the plan. An EIN was not previously required for the solo 401k we had with Etrade – do we need one now? Or is it only needed if we set up a checking account &/or invest in alternative assets outside of the brokerage accounts? We plan to continue holding only brokerage account investments.

ANSWER:

The 401k needs to have a

Status of E-TRADE Solo 401k BROKERAGE ACCOUNTS QUESTION

It’s been a few days since I sent in the ETrade brokerage account paperwork for the new brokerage acounts for the solo 401k that I opned with My Solo 401k Financial. I don’t see a new account listed at ETrade. Do you know the status?

ANSWER:

2) Call ETRADE Retirement Services number – 888-402-0654 and let the rep know you need a status on the brokerage account applications you submitted. This option may have long hold times to speak with a rep during this time of the year; however, they can assist you immediately. We are here to assist with the call if you need us.